How to Become a Bookkeeping for Personal And Business Accounting: Master the Essentials

Are you looking to take control of your financial destiny? Learning bookkeeping for both personal and business accounting could be your key to unlocking a world of financial clarity and success.

Imagine having the skills to manage your own finances with confidence, ensuring every dollar is accounted for and every opportunity seized. Whether you’re aiming to organize your household budget or manage a flourishing business, mastering bookkeeping can empower you to make informed decisions and pave the way for financial growth.

Get ready to discover the step-by-step process that can transform the way you handle your finances, making it easier and more efficient than ever before. Keep reading to uncover the secrets that could revolutionize your financial future.

Bookkeeping Basics

Understanding bookkeeping basics is essential for managing personal and business finances. Learning to track expenses, income, and balance sheets ensures clarity. With practice, anyone can efficiently organize financial data for accurate accounting.

Bookkeeping is the backbone of both personal and business finance management. Understanding the basics is crucial if you want to keep track of your money and make informed financial decisions. Whether you’re managing your own finances or aiming to help others, grasping the fundamentals of bookkeeping will set you on the right path.

Key Concepts And Terminology

Before diving into bookkeeping, familiarize yourself with essential terms. Assets, liabilities, and equity are the building blocks of any financial statement. Think of assets as what you own, liabilities as what you owe, and equity as your net worth. Revenue and expenses are also key. Revenue is the income you earn, while expenses are what you spend. Understanding these concepts helps you track your financial health. Journal entries are your day-to-day records. They capture every financial transaction, ensuring nothing slips through the cracks. Mastering these basics will make your bookkeeping journey smoother and more effective.

Types Of Bookkeeping Systems

Choosing the right bookkeeping system is crucial. Manual bookkeeping involves recording transactions by hand. It’s straightforward but time-consuming and prone to errors. Single-entry systems are simpler and suitable for personal finances. You track income and expenses in a basic ledger. It’s like balancing your checkbook, but on a slightly larger scale. Double-entry systems, on the other hand, are more robust. Each transaction affects two accounts, providing a complete picture of your finances. This system is ideal for businesses, ensuring accuracy and transparency.

Importance Of Accurate Records

Accurate records are the heart of good bookkeeping. They provide a clear view of your financial status, helping you make informed decisions. Imagine making a critical business choice without knowing your exact cash flow—risky, right? Keeping precise records also helps during tax season. It saves you from last-minute scrambles and potential penalties. You’ll have all your documents organized and ready to go. Moreover, accurate bookkeeping builds trust. Whether with investors, clients, or yourself, showing that you have your financial house in order instills confidence. So, how are your records looking today?

Essential Skills

Becoming a proficient bookkeeper requires mastering a set of essential skills. Whether you’re managing personal finances or handling business accounts, these skills form the backbone of successful bookkeeping. Let’s dive into the key abilities you need to develop to excel in this field.

Numeracy And Attention To Detail

Numbers are the language of bookkeeping. Having a strong grasp of basic math is crucial. You’ll often find yourself calculating totals, managing budgets, and reconciling accounts.

Attention to detail is equally important. A single misplaced decimal can lead to significant errors. Imagine balancing your own checkbook and realizing you’re off by just a few cents. It might seem minor, but those small discrepancies can add up over time.

Developing these skills means practicing regularly. Challenge yourself with real-world scenarios to sharpen your accuracy and build confidence in handling numbers.

Organizational And Time Management

Bookkeeping involves managing numerous documents and transactions. How do you keep everything in order? Strong organizational skills are your best ally.

Consider using a filing system that works for you, whether digital or physical. This ensures you can quickly access information when needed. Time management is another critical component. Allocate specific time slots for tasks to avoid last-minute rushes.

Have you ever felt overwhelmed by looming deadlines? Setting priorities and creating a daily schedule can alleviate that stress. This structured approach helps you stay on top of your bookkeeping duties without feeling swamped.

Familiarity With Accounting Software

In today’s digital age, accounting software is a bookkeeper’s best friend. Tools like QuickBooks or Xero streamline processes and reduce manual errors.

Have you explored these platforms yet? Familiarity with such software can enhance your efficiency. They offer features like automated reports and real-time data updates that save you significant time.

Start by choosing one platform and mastering it. Many offer free trials, providing an excellent opportunity to learn without a financial commitment. Embrace these tools to elevate your bookkeeping skills and keep pace with industry standards.

As you cultivate these essential skills, consider how they apply to your current or future bookkeeping endeavors. What steps can you take today to improve your proficiency? Remember, each skill you hone brings you closer to becoming an exceptional bookkeeper for both personal and business accounting.

Getting Started

Starting a bookkeeping journey involves understanding basic accounting principles. Learn to organize financial records and manage transactions efficiently. Building skills in personal and business accounting opens doors to diverse opportunities.

Getting started in bookkeeping can be an exciting journey. It involves managing finances effectively for personal and business needs. Knowing where to begin is crucial. This section guides you through the initial steps. It covers choosing tools, setting up accounts, and establishing routines.

Choosing The Right Tools

Selecting the right tools makes bookkeeping easier. Start with user-friendly software. Look for features that suit your specific needs. Online platforms offer convenience. They allow access from anywhere. Consider affordability and ease of use. Free trials can help evaluate options. Choose tools that streamline processes. Aim for accuracy and simplicity in your selection.

Setting Up A Chart Of Accounts

A chart of accounts organizes financial data. Begin by categorizing income and expenses. Create sections for assets, liabilities, and equity. Tailor the chart to your business type. Keep it clear and straightforward. Regular updates ensure accuracy. This setup lays a strong foundation. It helps track financial performance.

Establishing A Bookkeeping Routine

A routine keeps bookkeeping consistent. Set aside regular time each week. Review transactions and update records. Use reminders for important tasks. A checklist can enhance productivity. Monitor progress and adjust as needed. Consistency leads to better financial management. A routine simplifies the bookkeeping process.

Bookkeeping For Personal Finance

Bookkeeping for personal finance is an essential skill for managing money effectively. It helps individuals track their spending, save more, and plan for future expenses. By keeping detailed records, you can make informed decisions about your financial health. Whether you’re saving for a big purchase or aiming to reduce debt, bookkeeping can be your guide.

Tracking Income And Expenses

Tracking your income and expenses helps you understand your financial flow. Record every source of income, from salary to side hustles. Note every expense, even small ones. This practice reveals spending habits and areas to cut back. Use spreadsheets or budgeting apps to simplify the process.

Managing Personal Budgets

Managing a personal budget keeps your finances in check. Start by listing all necessary monthly expenses. Compare them to your income. Allocate funds for savings and discretionary spending. Adjust your budget as needed to avoid overspending. Stick to your plan for long-term benefits.

Monitoring Financial Goals

Monitoring financial goals keeps you focused on your targets. Set clear, achievable objectives like saving for a vacation. Track your progress regularly. Adjust your strategy if needed to stay on course. Celebrate small milestones to stay motivated. Achieving financial goals boosts confidence and stability.

Bookkeeping For Business

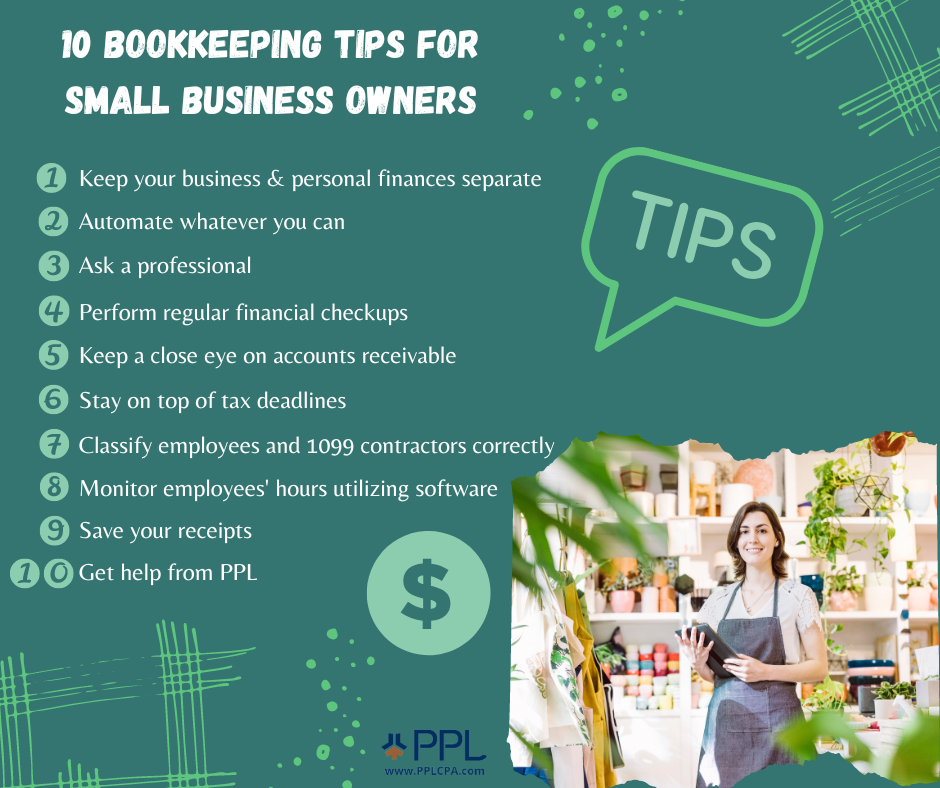

Bookkeeping for business is vital for financial health and growth. It involves tracking daily transactions, understanding financial data, and ensuring compliance with laws. A structured approach helps businesses make informed decisions and maintain transparency. Let’s explore the crucial aspects of business bookkeeping.

Recording Business Transactions

Accurate transaction recording is essential for any business. Every sale, purchase, and expense must be logged. This creates a clear financial picture. Use software or spreadsheets to keep records organized. Consistent tracking helps identify trends and areas for improvement.

Understanding Financial Statements

Financial statements provide insights into a business’s performance. Balance sheets show assets and liabilities. Income statements highlight profits and losses. Cash flow statements track money movement. Understanding these documents is key for strategic planning.

Complying With Tax Regulations

Tax compliance is crucial for any business. Know local and national tax rules. Keep detailed records of all transactions. This ensures accurate tax filings and avoids penalties. Regularly review tax obligations to stay informed and prepared.

Advanced Techniques

Advanced techniques in bookkeeping help refine your skills. These techniques provide deeper insights into financial data. They ensure accuracy and enhance decision-making. Mastering these skills is crucial for effective personal and business accounting.

Double-entry Bookkeeping

Double-entry bookkeeping records each transaction twice. It uses debits and credits. This method balances the books. It ensures all accounts are accurate. Assets equal liabilities plus equity. This system prevents errors and fraud. It offers a clear financial picture.

Reconciliation Processes

Reconciliation verifies accuracy between records. It compares internal and external data. For example, bank statements versus ledger entries. This process identifies discrepancies. It corrects errors in accounts. Regular reconciliation maintains financial integrity. It strengthens trust in your records.

Financial Analysis And Reporting

Financial analysis examines data to understand trends. It helps in forecasting future performance. Reporting presents findings clearly. It aids in decision-making. Reports include balance sheets, income statements, and cash flow statements. They provide a snapshot of financial health. Accurate analysis and reporting are vital for success.

Common Mistakes

Becoming proficient in bookkeeping requires attention to detail. Many beginners make common mistakes that can lead to inaccurate financial records. Understanding these pitfalls helps in maintaining precise and reliable accounting. Let’s explore some frequent errors in bookkeeping and learn how to avoid them.

Avoiding Data Entry Errors

Data entry errors are common in bookkeeping. Incorrect numbers or misplaced decimals can lead to big problems. Double-check every entry. Use software tools to minimize errors. Regular audits can catch mistakes early.

Preventing Misclassification

Misclassification of transactions can skew financial data. It’s crucial to categorize expenses and income correctly. Familiarize yourself with different account types. Consistent training helps in identifying the right categories. Use a chart of accounts for guidance.

Ensuring Consistent Record Keeping

Inconsistent record keeping disrupts financial tracking. Maintain uniform documentation practices. Record every transaction promptly. Regularly reconcile accounts to ensure accuracy. Establish a routine for updating records. This builds a reliable bookkeeping system.

Continuing Education

Continuing education is crucial for any bookkeeper. It ensures you stay ahead in personal and business accounting. As technology and regulations evolve, staying informed is vital. Regular learning helps you adapt to industry changes and maintain your skills. It also enhances your credibility and job performance. Let’s explore how to continue your education effectively.

Staying Updated With Industry Trends

Industry trends change rapidly. To stay current, read industry publications and blogs. Attend webinars and workshops that focus on new technologies and regulations. Follow thought leaders on social media for fresh insights. This keeps your knowledge sharp and relevant.

Pursuing Certification

Certifications validate your skills and knowledge. Consider programs like the Certified Bookkeeper (CB) from AIPB. These certifications boost your resume and confidence. They also offer specialized training and help you stand out. Research different programs to find one that fits your career goals.

Joining Professional Networks

Professional networks offer valuable resources and connections. Join organizations like the American Institute of Professional Bookkeepers (AIPB). Attend local meetups and conferences to meet other professionals. Networking provides support and new opportunities. It also allows you to share knowledge and learn from peers.

Frequently Asked Questions

What Skills Are Needed For Bookkeeping?

To become a bookkeeper, you need attention to detail, organizational skills, and proficiency in math. Familiarity with accounting software and financial principles is essential. Strong communication and problem-solving abilities also play a crucial role. Continuous learning and adaptability are important, as financial regulations and software can change over time.

How Do You Start A Bookkeeping Career?

Begin by acquiring basic accounting knowledge through courses or certifications. Gain practical experience through internships or entry-level positions. Networking and joining professional organizations can provide valuable connections and resources. Consider obtaining certifications like Certified Bookkeeper (CB) to enhance credibility and career prospects in bookkeeping.

Is Bookkeeping Software Necessary For Beginners?

Yes, bookkeeping software streamlines financial tasks and minimizes errors. It helps beginners manage transactions, generate reports, and maintain accurate records efficiently. Many software options offer user-friendly interfaces and tutorials, making them accessible for beginners. Using software can significantly enhance productivity and accuracy in bookkeeping practices.

How Does Bookkeeping Differ For Personal And Business Accounting?

Personal bookkeeping focuses on managing individual finances, tracking expenses, and budgeting. Business bookkeeping involves handling financial transactions, payroll, and tax compliance for companies. Business accounting is more complex and requires detailed record-keeping and reporting. Both require accuracy, but business bookkeeping often involves more regulatory requirements.

Conclusion

Becoming a bookkeeper is a rewarding journey. Start by learning the basics. Practice regularly to gain confidence. Explore online courses and local classes. Use software tools for efficiency. Keep up with trends in accounting. Networking with professionals helps a lot.

Seek feedback to improve your skills. Remember, patience and practice make perfect. Don’t hesitate to ask questions. Stay organized and focused on details. With dedication, you’ll succeed in personal and business bookkeeping. Happy learning!